Umbra Space recently made some big announcements after being fairly quiet for the last several years. Umbra, which was initially dismissed by analysts and experts alike, has stunned the industry with its unique customer-focused business model, seemingly unparalleled satellite performance, and multi-year financial commitment from Maxar for detected capacity.

In 2020, we stopped writing stories on Umbra because we believed their technology was too good to be true. We were not alone in our skepticism, dismissing Umbra’s claims as startup exaggerations, while some radar experts flat-out denied that their capabilities were possible. Investors often lumped Umbra together with other SAR startups, believing that they lacked unique technology in a crowded hyped market.

Now, the industry must face a very scary and difficult reality. Umbra kept their promises about everything. A reminder that sometimes, the most revolutionary ideas are the ones that seem too good to be true.

It’s not that Umbra can sell “Highest resolution ever offered.” It’s the amount of data Umbra can sell at that resolution “Each satellite captures up to 15x more daily images than the competition” this increase in imaging capacity comes from a larger field of regard and Umbra’s patented technology.

Umbra’s founders are lifelong friends who grew up in Santa Barbara, CA. David Langan, Umbra’s CEO, spent nearly a decade architecting advanced space missions, later inventing Umbras core technology. Gabe Dominocielo, co-founder and President is a lifelong entrepreneur with an unreasonable obsession with unit economics and free cash flow.

Understanding Why Umbra Space is Different

The Maxar/Umbra Deal

Maxar, was the only profitable publicly traded EO company before being acquired by Advent at a 129% premium to its share price. Maxar, with a long-standing presence in the industry is widely regarded as a leading player in the sector.

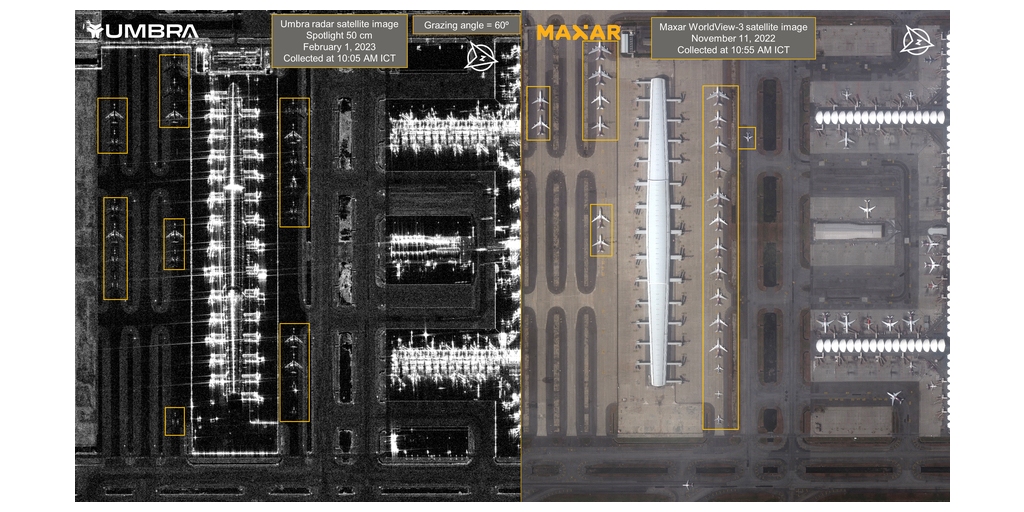

Maxar’s Ypsilanti-based radar group has been working on advanced SAR programs for decades, giving Maxar an unrivaled level of expertise and insight into the industry. Tony Frazier, EVP of Maxar Earth intelligence, told SpaceNews “Maxar has agreements with third-party SAR providers, but it chose Umbra for a dedicated partnership because the company’s high-resolution SAR better complements Maxar. This partnership gives Umbra clear validation, cementing Umbra as a serious player in the market.

Why it Makes Sense for Maxar

- Umbra can solve Maxar’s biggest problem: clouds and darkness. Maxar can offer guaranteed images, allowing them to monetize collections 24/7, Umbra’s SAR is uniquely suited to provide reliable and continuous monitoring.

- In early February, Maxar was awarded a $192M IDIQ contract by the US Government to share imagery to allies. An element of this contract is commercial SAR.

- In September, NGA renewed Maxar’s G-EGD imagery contract with a total value of $176 million, a contract on which Umbra Space is already a sub-contractor.

- In May, Maxar won the largest ever commercial imagery acquisition contract awarded by the NRO, called Electro-Optical Commercial Layer (EOCL). Maxar’s previous smaller contract called Enhanced View was for $1B USD.

Why it Makes Sense for Umbra

- Umbra gets the Maxar a stamp of approval from the most knowledgable conglomerate in the industry.

- Advent, Maxar’s parent company has $89B under management and is highly motivated to gobble up defense technology companies and is willing to pay a premium.

- Umbra can immediately sell data to allied governments (https://www.maxar.com/products/sar-imagery) via Maxar platforms.

- Maxar’s contracts allow Umbra to leapfrog years of grinding complex US and foreign government relationships.

Umbra’s Prices

Umbra’s prices are on their website. This is not done in the industry, prices are heavily negotiated under NDA’s. Umbra’s prices are 90% lower than Airbus and e-GEOS list prices. Understand this paradox from a customer’s perspective, would you pay 10x more for the same product? 3x for a worse product? Neither will anyone else.

Umbra’s Prices

- $500 for a 1 meter image is very difficult to compete against.

- $750 for a 50 centimeter image is impossible to compete against.

- $3000 for a 25 centimeter image, which is the best product on the market. In an industry where 1 meter images can be sold for tens of thousands of dollars, buying the best product in the world for a fraction of the cost is a pretty good deal.

Umbra’s open pricing will force other providers to re-negotiate existing contracts lower reducing their revenues an unfavorable position in a tight liquidity market.

Open License

The satellite industry is known for having extremely restrictive licenses which makes data very difficult to buy or use. Umbra is providing a standard “Creative Commons License, which gives you the right to do just about anything you want with it.” Which means customers have more flexibility and can make more money when working with Umbra. Read the full TOS

No Analytics

“Umbra does not do analytics.” It’s simple, Umbra is not competing with their customers and is free of channel conflicts. This should have been abundantly clear when Umbra hired Joe Morrison, a customer zealot and the most famous contrarian in the satellite industry. More from Umbra’s website:

- Competing with your customers. Tricky at best, disastrous at worst.

- By competing with your customers, you stifle the growth of the satellite data industry.

- We have enough on our plate innovating our satellites and core infrastructure. Trying to boil the ocean doesn’t work.

- It’s expensive and distracts from our core business model.

What Does this Mean for the SAR Competitive Landscape?

The best product, at the lowest price and no channel conflicts… Everything you thought about the multi-billion dollar Earth observation market is going to be forced to violently change.

I don’t know what will happen next, but one thing is certain: Umbra’s pricing model is good for users of SAR and those seeking ground truth. It lowers the financial barrier to entry, makes data easy to use, share, and allows the GEOINT to expand the industry.

This is a game-changer.